Frequently asked questions

-

What’s changed when I use my card to shop online?

We’ve made changes making shopping online with your card more secure and reducing fraud. These changes introduce Strong Customer Authentication (SCA) for online card transactions. SCA is an extra layer of security where you authenticate your online card purchases.

You can find out more about SCA here.

-

Financial scams are on the increase. If I receive a call from the bank how will I know it is genuine?

Fraudsters are using the publicity around the Coronavirus to pose as genuine organisations, including bank staff, government and/or health service officials. They are claiming to help keep your money safe, or to offer investment and / or medical advice at a cost.

Remember: AIB or other organisations, such as law enforcement agencies, will NEVER ask you to transfer money, move it to a safe account, nor ask you to disclose your security credentials, personal or financial information by phone, email or text message.

For more information visit https://aibni.co.uk/security-centre

-

How do I stop receiving paper statements?

With Online Banking you can choose to stop paper statements on your eligible accounts.

Just four simple steps, and all you need is your Online Banking login details and your mobile phone number.

You will receive a text message each time a new eStatement is available to view simply login to Online Banking or the Mobile App

To find out more click here.

Important Information

- Independent service quality survey results - Personal current accounts

- Independent service quality survey results - Business current accounts

- Withdrawal of First Trust Bank banknotes from circulation

- Important customer & regulatory information

- Interbank Offered Rate (IBOR) Transition

-

Independent service quality survey results - Personal current accounts

Click to view full Survey ResultsOverall service quality

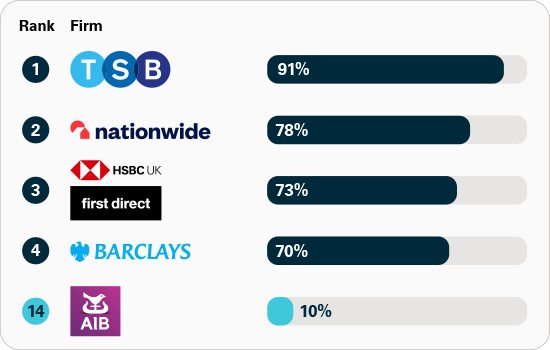

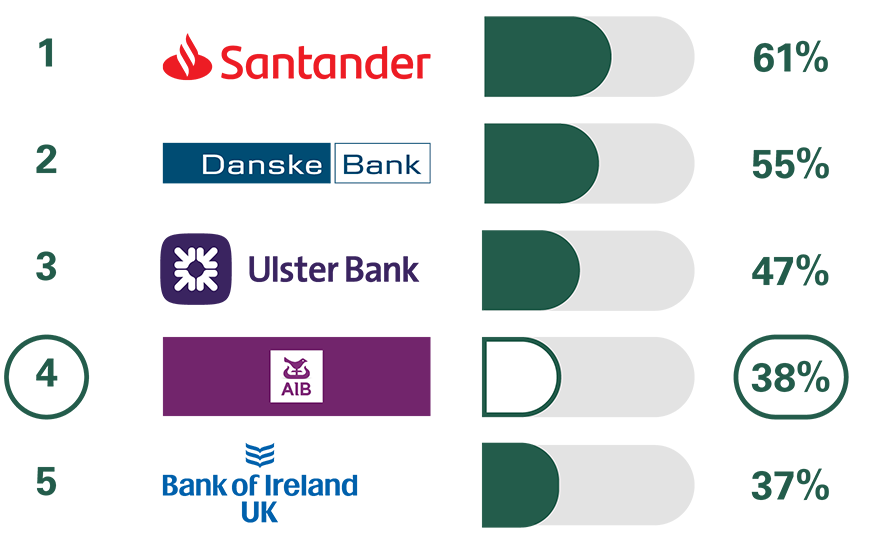

We asked customers how likely they would be to recommend their personal current account provider to friends and family.

Ranking

Published February 2024

As part of a regulatory requirement, an independent survey was conducted to ask approximately 500 customers of each of the 11 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.Information about current account services

The requirement to publish the Financial Conduct Authority Service Quality Information for personal current accounts can be found here, and for business current accounts here. -

Independent service quality survey results - Business current accounts

Click to view full Survey ResultsOverall service quality

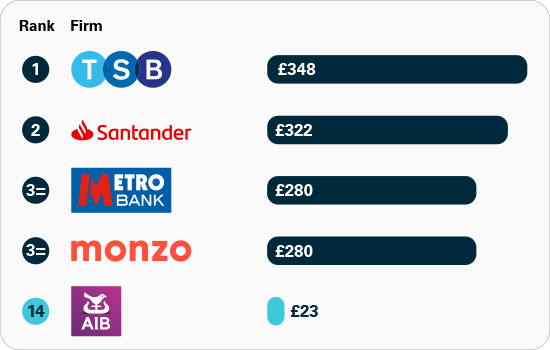

We asked customers how likely they would be to recommend their business current account provider to other SMEs.

Ranking

Published February 2024

As part of a regulatory requirement, an independent survey was conducted to ask approximately 600 customers of each of the 5 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs). The results represent the view of customers who took part in the survey.Information about current account services

The requirement to publish the Financial Conduct Authority Service Quality Information for business current accounts can be found here, and for personal current accounts here. -

Withdrawal of First Trust Bank banknotes from circulation

Find out moreWe have ceased issuing First Trust Bank banknotes and now dispense Bank of England banknotes through our ATM Network. From 1st July 2022 you can no longer spend or accept First Trust Bank Banknotes. For further information, including how to lodge or exchange your First Trust Bank banknotes click on ‘Find out more’ below

-

Important customer & regulatory information

Find out moreFind out more information about regulation or product changes that may impact you and your banking with us

-

Interbank Offered Rate (IBOR) Transition

Find out moreNew risk free Benchmark Rates are being developed.

Benchmark Rates are used in financial transactions throughout our economy and are an integral part of interest rate markets. All banks, including AIB, use them in the pricing of many products.

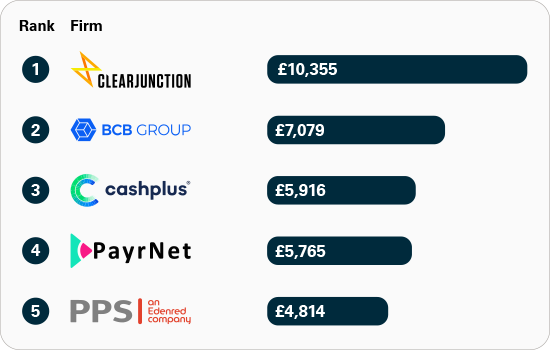

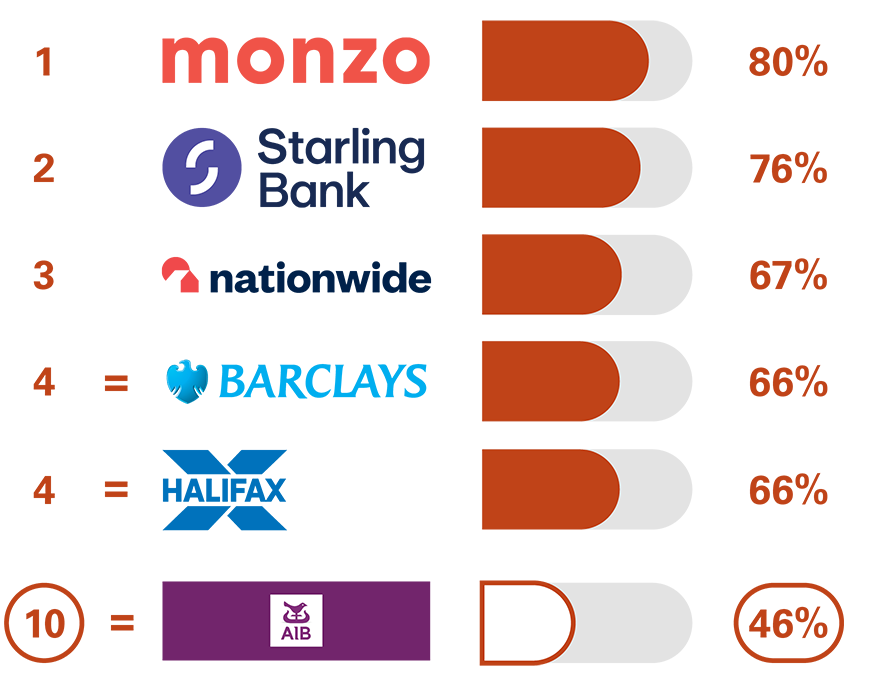

Authorised push payment (APP) fraud rankings in 2022

Authorised push payment (APP) fraud happens when someone is tricked into transferring money to a fraudster's bank account. You can read the full report by visiting www.psr.org.uk/app-fraud-data