Convert sales to cash quickly and boost your working capital

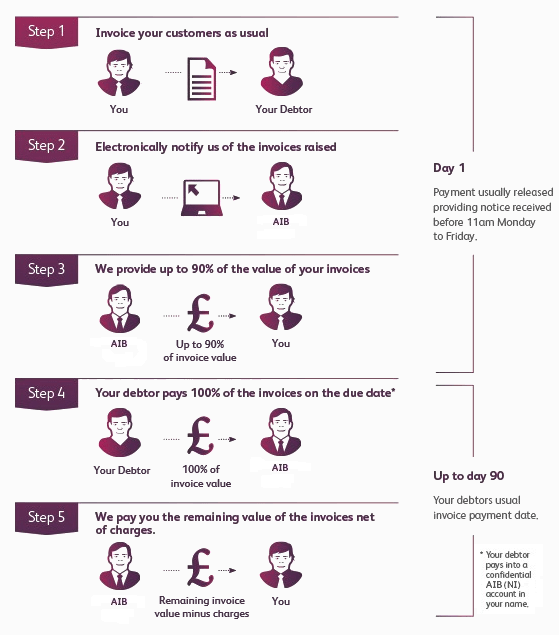

AIB (NI) will provide your business with an upfront release (prepayment) of up to 90% of the value of your outstanding customer invoices. You can stay competitive by quickly converting sales to cash, maintaining a healthy cash flow and paying your suppliers in full and on time.

Invoice Finance features

- Features and benefits

- Is your business suitable?

- How it works

- Customer example

- Costs

Talk to Us

Simply call 0345 6005 925† or visit your nearest branch. We’ll be happy to answer any questions you might have about applying for Invoice Finance.

† Lines open: Monday - Friday 09:00 - 17:00 (except on bank holidays). Calls may be recorded. Call charges may vary - refer to your service provider.