FRAUD WARNING

AIB are aware of fraudsters contacting customers via text message and phone calls, purporting to be AIB. Find out more

Business Sustainability Loan

For businesses investing in the transition to a more sustainable future.

Access to Cash

We’ve committed to working with other banks and cash service providers to support a new Government-led initiative known as Access to Cash.

For information on the regulations, including cash services available in your area and how to request a Cash Access Assessment.

See our Access to Cash page.

Throwback to an incredible evening at the ICC Belfast for the AIB Business Eye Awards 2024! 🏆

AIB Business Eye Awards recognise those leading the way for business in Northern Ireland. Congratulations once again to all the 2024 winners!

Frequently asked questions

- What’s changed when I use my card to shop online?

- Financial scams are on the increase. If I receive a call from the bank how will I know it is genuine?

Important Information

- Independent service quality survey results - Business current accounts

- Independent service quality survey results - Personal current accounts

- SME Banking Comparison Tools

- Withdrawal of First Trust Bank banknotes from circulation

- Important customer & regulatory information

-

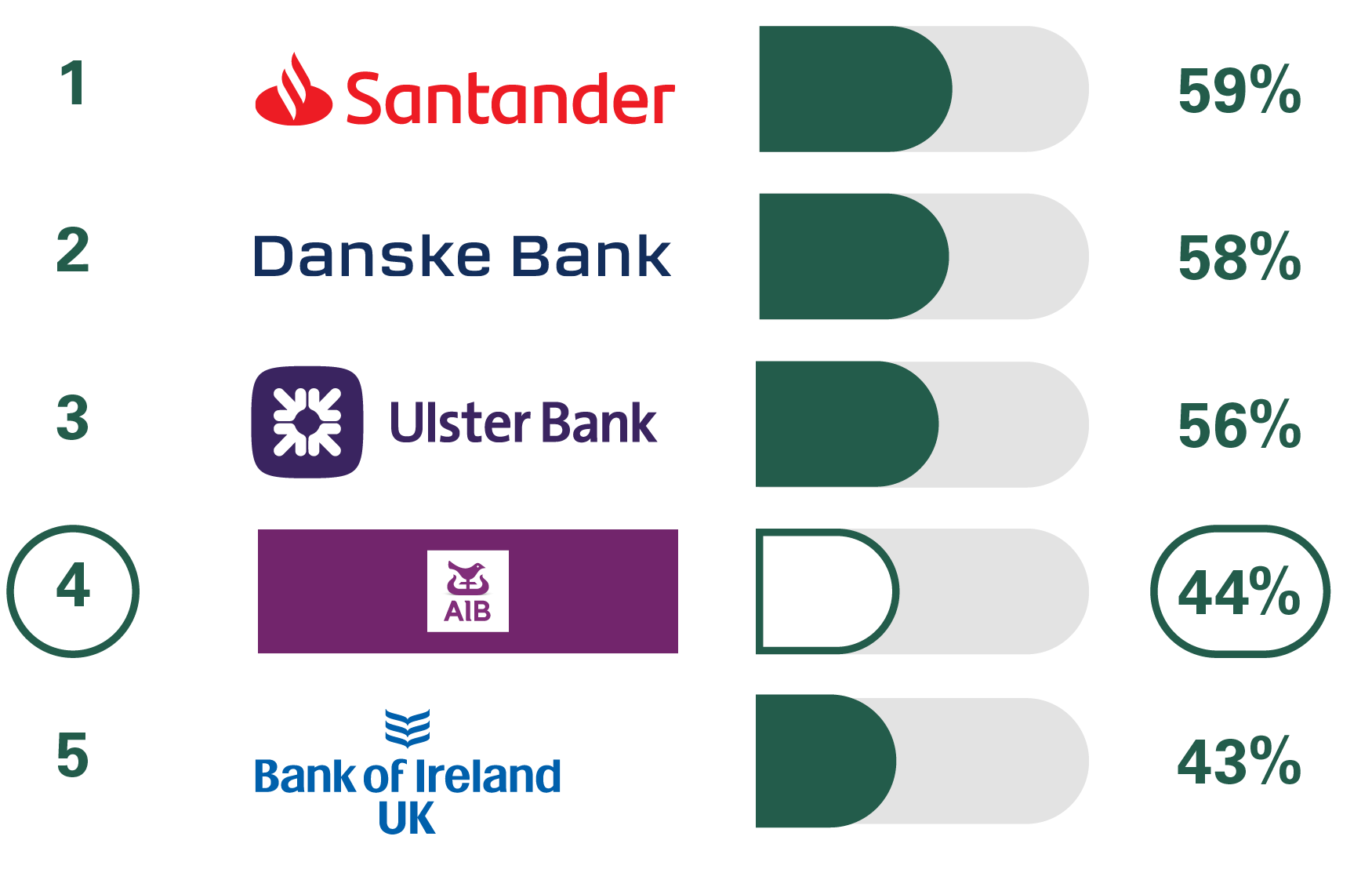

Independent service quality survey results - Business current accounts

Click to view full Survey ResultsOverall service quality

We asked customers how likely they would be to recommend their business current account provider to other SMEs.

Ranking

Published February 2026

As part of a regulatory requirement, an independent survey was conducted to ask approximately 600 customers of each of the 5 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs). The results represent the view of customers who took part in the survey.Information about current account services

The requirement to publish the Financial Conduct Authority Service Quality Information results can be found in the Information about personal current account services, and in the Information about business current account services. -

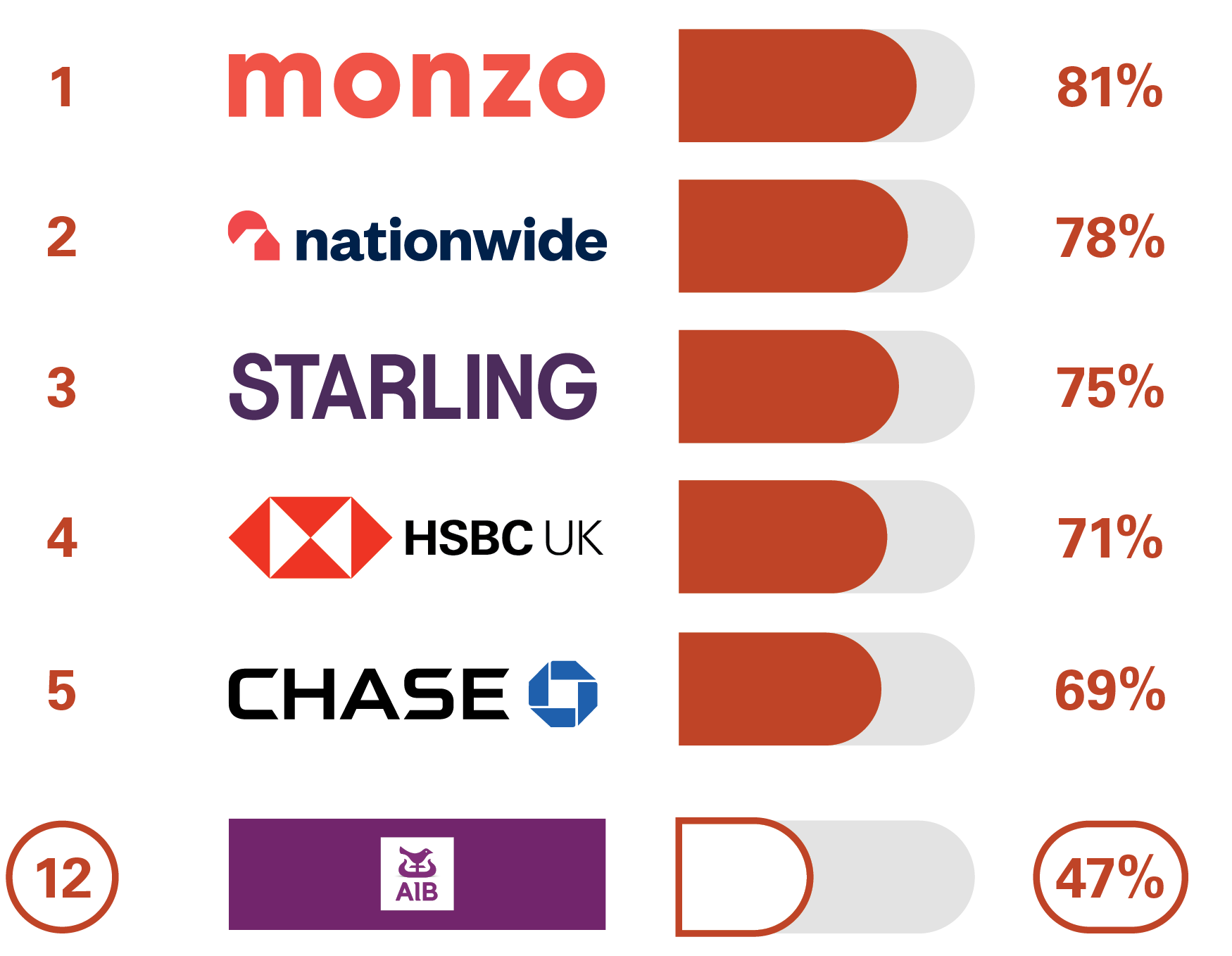

Independent service quality survey results - Personal current accounts

Click to view full Survey ResultsOverall service quality

We asked customers how likely they would be to recommend their personal current account provider to friends and family.

Ranking

Published February 2026

As part of a regulatory requirement, an independent survey was conducted to ask approximately 500 customers of each of the 12 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.Information about current account services

The requirement to publish the Financial Conduct Authority Service Quality Information results can be found in the Information about personal current account services, and in the Information about business current account services. -

SME Banking Comparison Tools

Use the links below to access the Government Designated Finance Platforms:

Government Designated Finance Platforms

Funding Xchange www.fundingxchange.co.uk/cma14 Funding Options www.fundingoptions.com Alternative Business Funding www.alternativebusinessfunding.co.uk/

Finance Platforms are credit brokers regulated by the Financial Conduct Authority (FCA), they are not lenders.

SME’s are small and medium-sized enterprises which have annual sales revenue (exclusive of VAT and turnover-related taxes) not exceeding £25m.Use the links below to access some competitor analysis websites:

Competitor Analysis Platforms

Swoop https://swoopfunding.com/open-banking.html?bank=aib Funding Options www.fundingoptions.com -

Withdrawal of First Trust Bank banknotes from circulation

Find out moreWe will gradually withdraw First Trust Bank banknotes from circulation. We are now dispensing Bank of England banknotes through our ATM Network. You can continue to spend, accept and lodge First Trust Bank notes until midnight on 30th June 2022.

-

Important customer & regulatory information

Find out moreFind out more information about regulation or product changes that may impact you and your banking with us