Authorised push payment (APP) fraud rankings in 2022

Authorised push payment (APP) fraud happens when someone is tricked into transferring money to a fraudster's bank account. You can read the full report by visiting www.psr.org.uk/app-fraud-data

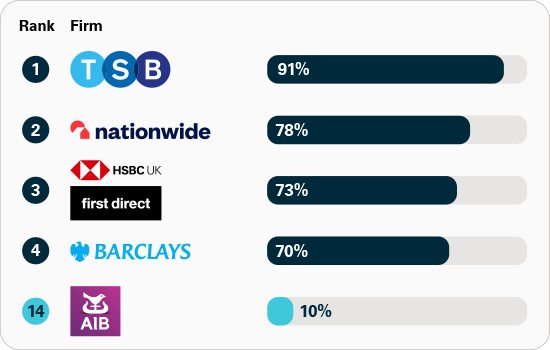

Share of App fraud refunded

This data shows the proportion of total APP fraud losses that were roimbursed, out of 14 firms. Higher figure is better.

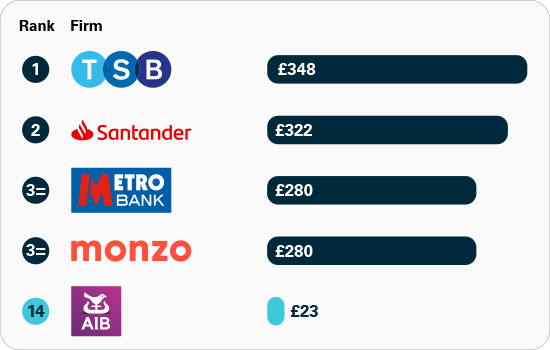

AIB fraud sent per £million transactions

This data shows the amount of APP fraud sent per million pounds of transactions, out of 14 firms. Lower figure is better.

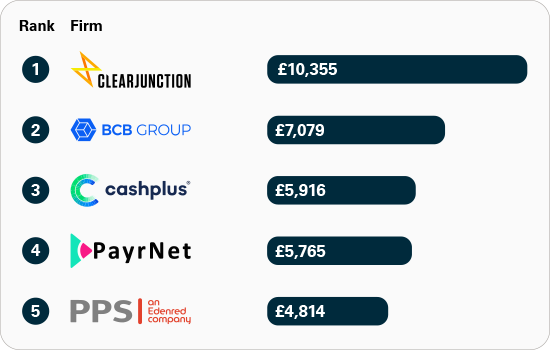

APP fraud received per £million transactions: smaller UK banks and payment firms

This data shows the amount of APP fraud received per million pounds of transactions, ranked out of 20 firms. Lower figure is better.

APP fraud received per £million transactions:major UK banks and building societies

This data shows the amount of APP fraud received per million pounds of transactions ranked out of 20 firms. Lower figure is better.