FRAUD WARNING

AIB are aware of fraudsters contacting customers via text message and phone calls, purporting to be AIB. Find out more

Increase in UK FSCS Deposit Protection to £120,000 – what does this mean for you?

Looking after your savings is important and so is knowing they’re safe. The Financial Services Compensation Scheme (FSCS) deposit protection limit for eligible deposits has increased from £85,000 to £120,000 for each person as of 1 December 2025.

Some life events can give you a lot of money, for a short time. For example, selling your home or receiving an inheritance can do this. For these situations, the FSCS offers Temporary High Balance (THB) protection for up to six months. The THB limit has also increased from £1 million to £1.4 million.

Regular Saver - A flexible account that rewards you for saving regularly

We're always encouraging our customers to make the most of their money.

More about Regular Saver account.

Frequently asked questions

- What’s changed when I use my card to shop online?

- Financial scams are on the increase. If I receive a call from the bank how will I know it is genuine?

- How do I stop receiving paper statements?

Important Information

- Independent service quality survey results - Personal current accounts

- Independent service quality survey results - Business current accounts

- Withdrawal of First Trust Bank banknotes from circulation

- Important customer & regulatory information

-

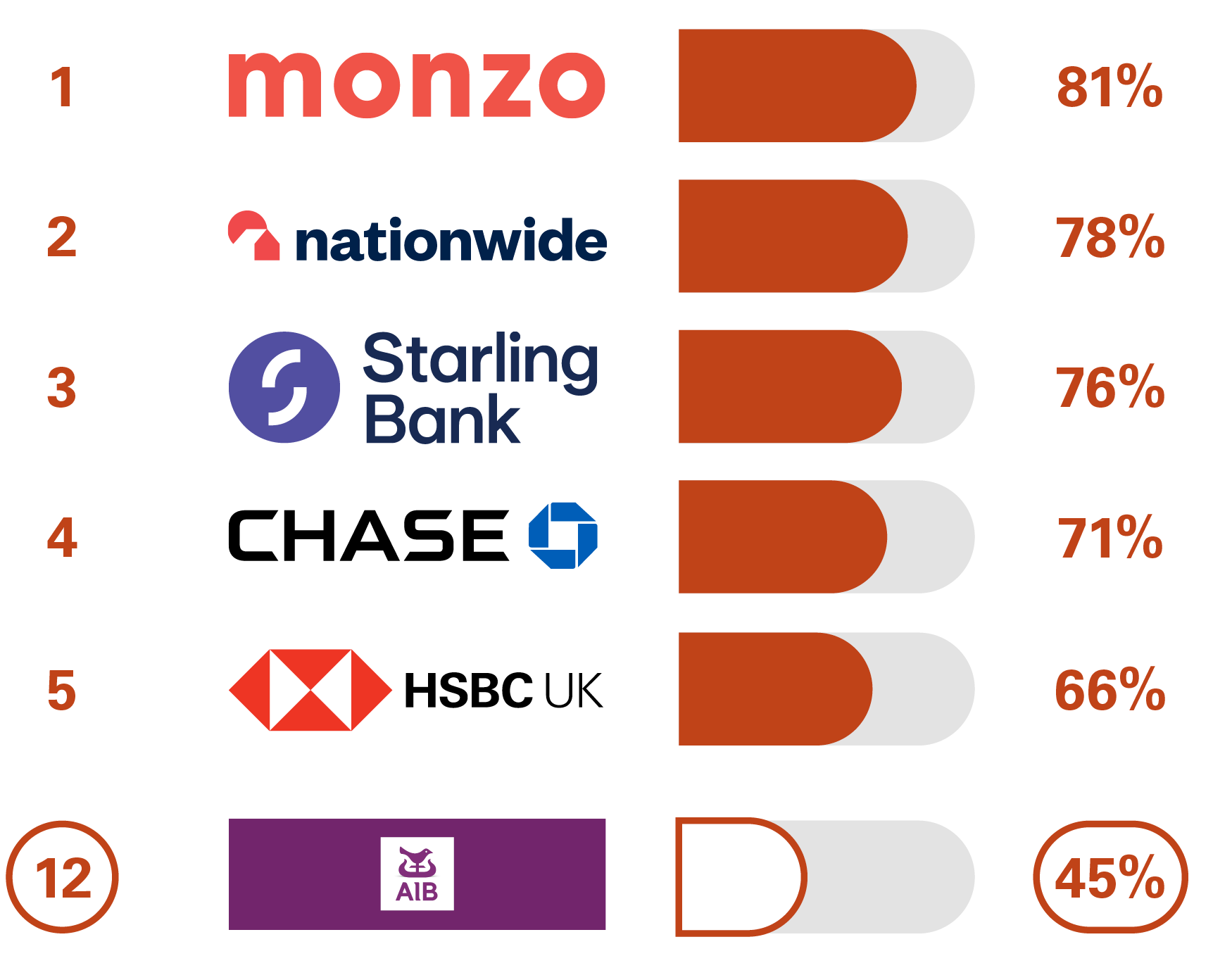

Independent service quality survey results - Personal current accounts

Click to view full Survey ResultsOverall service quality

We asked customers how likely they would be to recommend their personal current account provider to friends and family.

Ranking

Published August 2025

As part of a regulatory requirement, an independent survey was conducted to ask approximately 500 customers of each of the 12 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.Information about current account services

The requirement to publish the Financial Conduct Authority Service Quality Information results can be found in the Information about personal current account services, and in the Information about business current account services. -

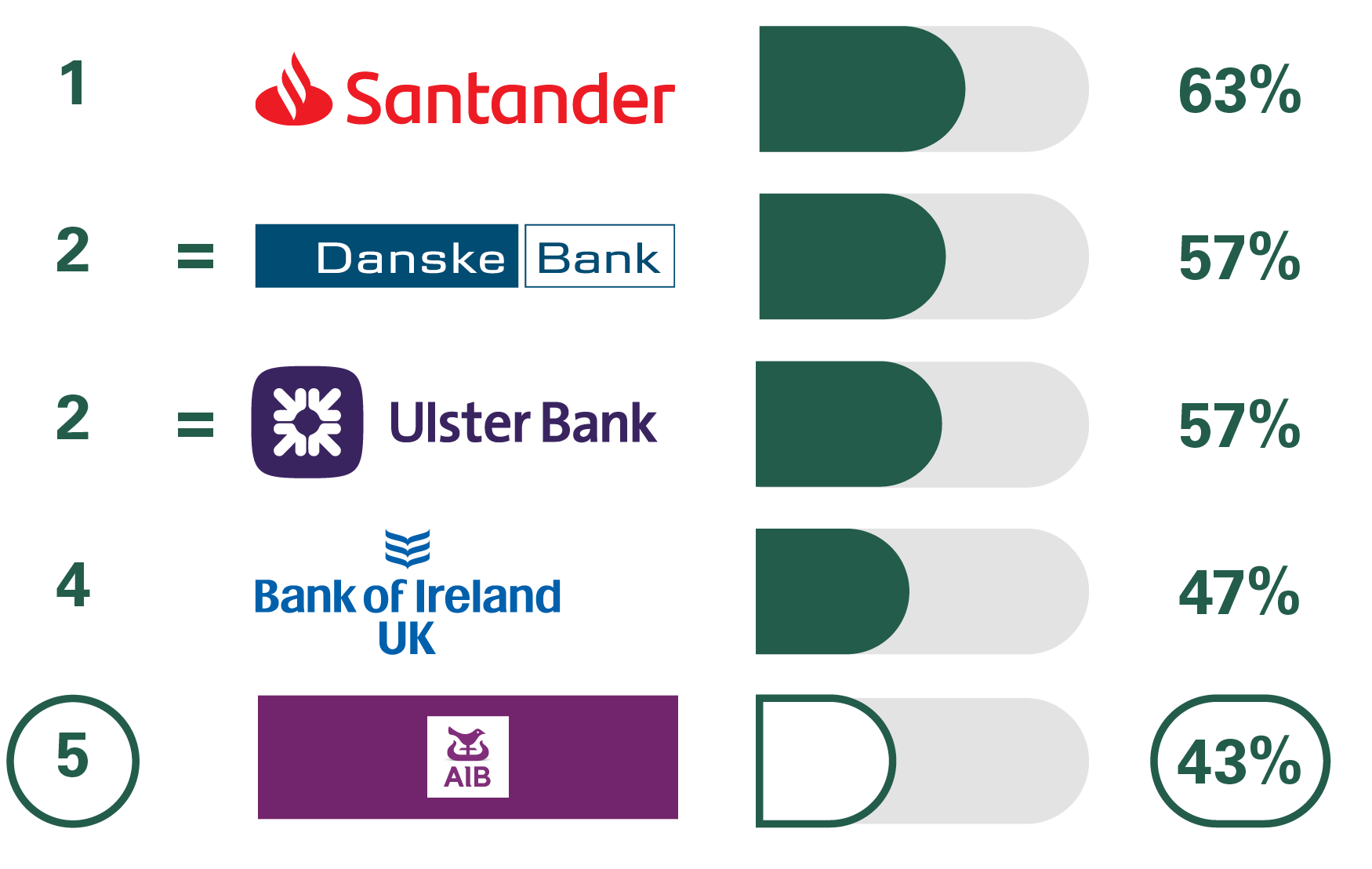

Independent service quality survey results - Business current accounts

Click to view full Survey ResultsOverall service quality

We asked customers how likely they would be to recommend their business current account provider to other SMEs.

Ranking

Published August 2025

As part of a regulatory requirement, an independent survey was conducted to ask approximately 600 customers of each of the 5 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs). The results represent the view of customers who took part in the survey.Information about current account services

The requirement to publish the Financial Conduct Authority Service Quality Information results can be found in the Information about personal current account services, and in the Information about business current account services. -

Withdrawal of First Trust Bank banknotes from circulation

Find out moreWe have ceased issuing First Trust Bank banknotes and now dispense Bank of England banknotes through our ATM Network. From 1st July 2022 you can no longer spend or accept First Trust Bank Banknotes. For further information, including how to lodge or exchange your First Trust Bank banknotes click on ‘Find out more’ below

-

Important customer & regulatory information

Find out moreFind out more information about regulation or product changes that may impact you and your banking with us

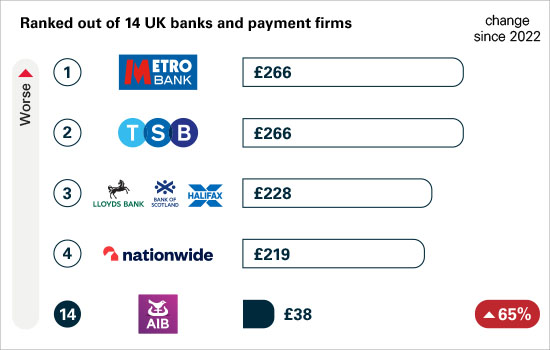

Authorised push payment (APP) scams rankings in 2023

APP scams received per £million transactions: smaller UK banks and payment firms

This is the amount of money received into the scammer’s account from the victim, ranked out of all UK banks and payment firms.

For example, for every £1 million received into consumer accounts at Skrill, £18,550 of it was APP scams.

|

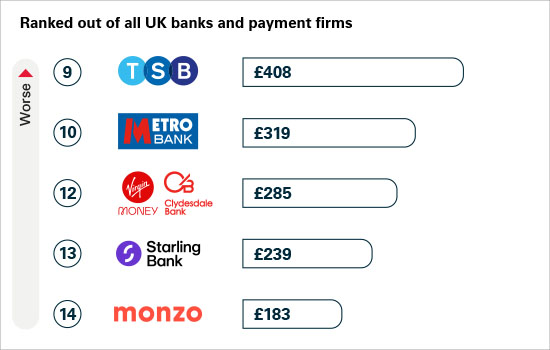

APP scams received per £million transactions: major UK banks and building societies

This is the amount of money received into the scammer’s account from the victim, ranked out of all UK banks and payment firms.

For example, for every £1 million received into consumer accounts at TSB, £408 of it was APP scams.

|