At certain stages you may have a substantial sum of money to put into savings

With a AIB (NI) Fixed Term Deposit Account, you can put away a lump sum for a fixed term and benefit from the security of a fixed rate of interest, regardless of money market fluctuations.

The minimum deposit to open a Fixed Term Deposit Account for personal customers is £800,000. There is no maximum balance restriction with this account.

Features and benefits

- A fixed rate of interest for the duration of the term

- Choice of terms - from seven days to five years

- Monthly income option available

- No withdrawals permitted until maturity*

- Lodgements permitted at maturity

- A choice of maturity instructions available

- Open your account today

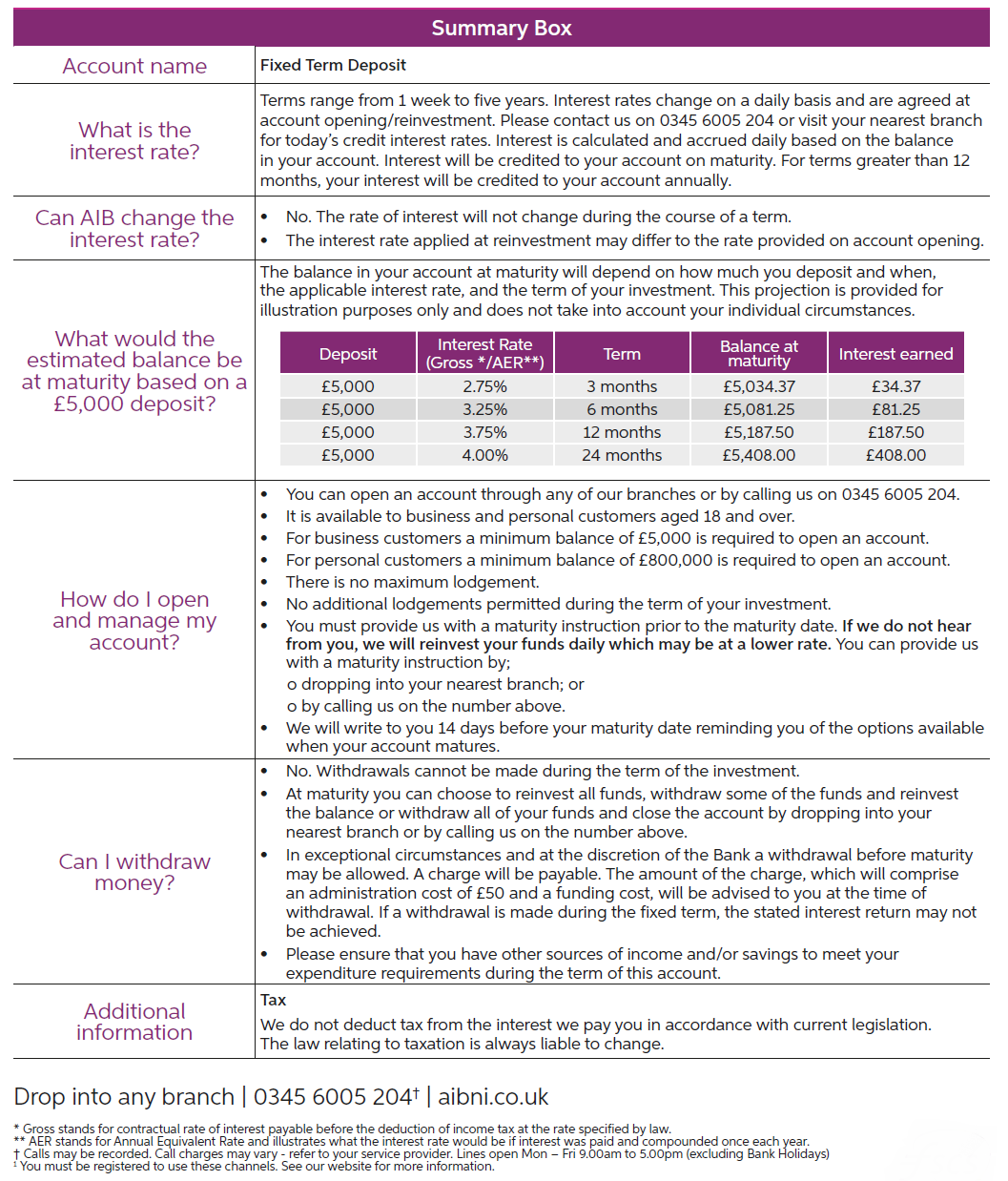

Fixed Term Deposit Summary Box

This summary box sets out key product features that apply to our Fixed Term Deposit account. You should carefully read this document along with the Fixed Term Deposit Terms and Conditions to allow you make an informed decision as to whether this product is right for you.

If you require this summary box in PDF format, please download here.

Talk to Us

We’re ready to help you start saving today.

Simply call 0345 6005 925† , or drop into any AIB branch. We’ll be happy to answer any questions you may have and help you find the right kind of savings account for your business.

† Lines open: 9am to 5pm Monday - Friday (except on bank holidays). Calls may be recorded. Call charges may vary - refer to your service provider.

Help and Guidance

Terms and conditions

View the Fixed Term Deposit Account terms and conditions.

Fees and Charges

View the price list for business customers.

Savings calculator

Find out how savings can add up

Important information about taxation

Find out how we apply tax on savings in line with current legislation.

Foreign Account Tax Compliance Act (FATCA)

View information about the Foreign Account Tax Compliance Act and how this applies to business customers.

Financial Services Compensation Scheme

Check what protection the Financial Services Compensation Scheme offers you.