Save up to £20,000 - your 2025/26 allowance.

A Cash ISA is a simple, instant access, easy-to-use savings account. The interest you get paid is tax free, which helps you make the most of your savings.

To invest in a Cash ISA you must be aged 18 or over (or aged 16 or 17 before 06 April 2024) and resident in the UK for tax purposes (excluding Isle of Man and Channel Islands)

*Gross stands for contractual rate of interest payable before the deduction of income tax at the rate specified by law.

**AER Stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year.

Features and benefits

- Open an account with as little as just £50 and save up to £20,000, which is your 2025/26 allowance*

- Earn a competitive tax-free rate of interest on your savings

- Access to your savings when you need it

- Transfer in balances from any existing ISA's you hold

- Open your account today

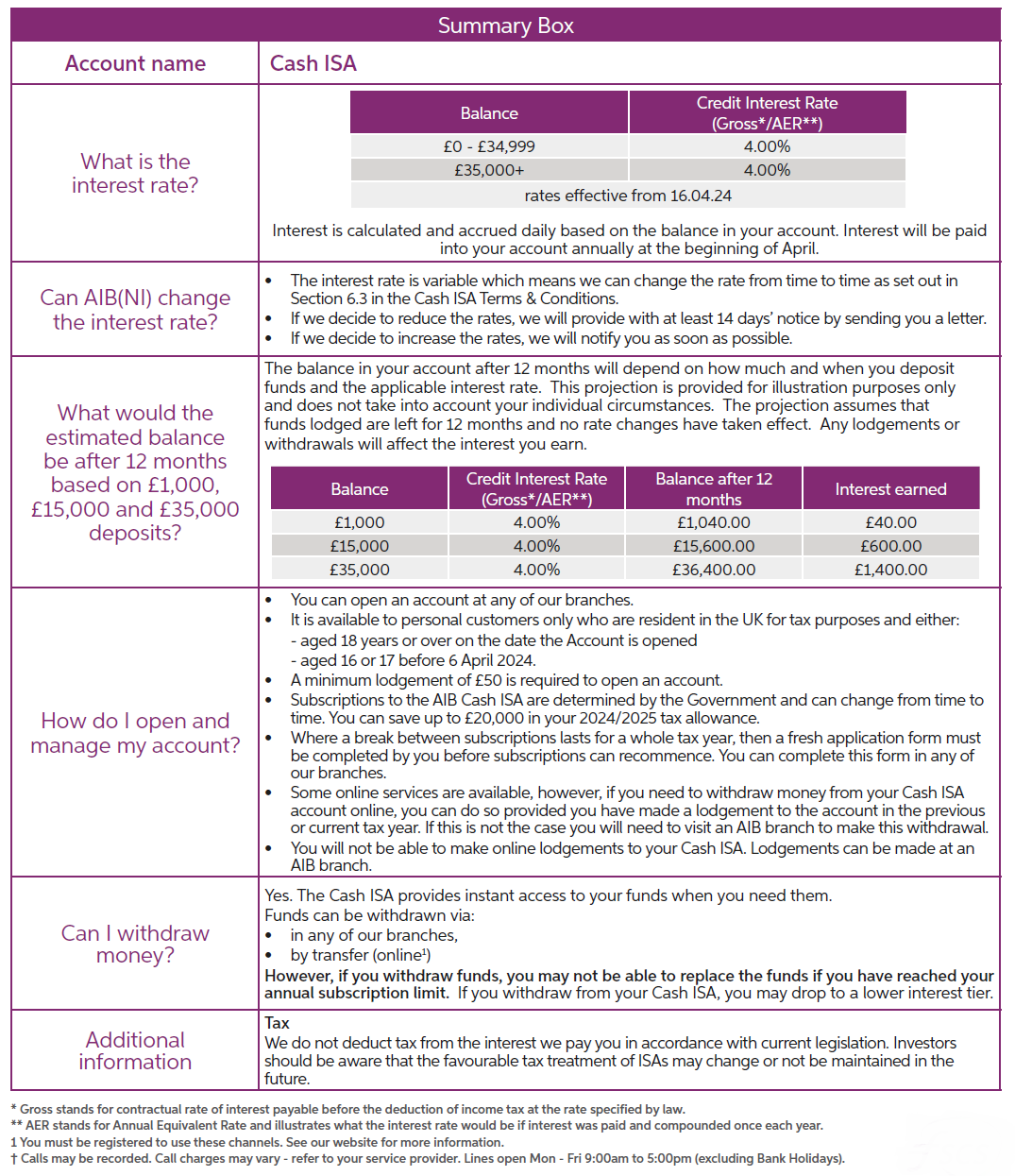

Cash ISA Summary Box

This summary box sets out important information that applies to our Cash ISA account. You should carefully read this document along with the Cash ISA Terms and Conditions to allow you make an informed decision as to whether this product is right for you.

If you require this summary box in PDF format, please download Cash ISA Summary Box PDF.

Important information

- Information on the tax treatment of ISAs

Talk to Us

We’re ready to help you start saving today.

Simply call us on 03456 005 925† , or drop into any AIB branch. We’ll be happy to answer any questions you may have and help you find the right kind of savings account for you.

† Lines open: 9am to 5pm Monday - Friday (except on bank holidays). Calls may be recorded. Call charges may vary - refer to your service provider.

Help and Guidance

Cash ISA terms and conditions

View the Cash ISA terms and conditions.

Savings calculator

Find out how even the smallest amount of regular savings will add up.

Deposit rates

Find out more about our deposit account rates.

Help Centre

For all service related queries please visit our Help Centre.

Financial Services Compensation Scheme

Check what protection the Financial Services Compensation Scheme offers you.

Additional support for customers

Should you require any additional support from the bank to help you manage your banking.