A savings account tailored to your needs.

This is an account designed especially for regular savers, which allows you to save what you want, when you want, and how you want. So if flexibility is important to you, then this account may fit the bill.

When you open an account in branch or online we will ask you for a regular savings instruction to debit between £10 to £500 per month from a AIB (NI) Select Account or Current Account. If you are a new customer or do not already have a suitable account, talk to us about how we can help.

Please note you must be a UK resident to open an account with us.

Features and benefits

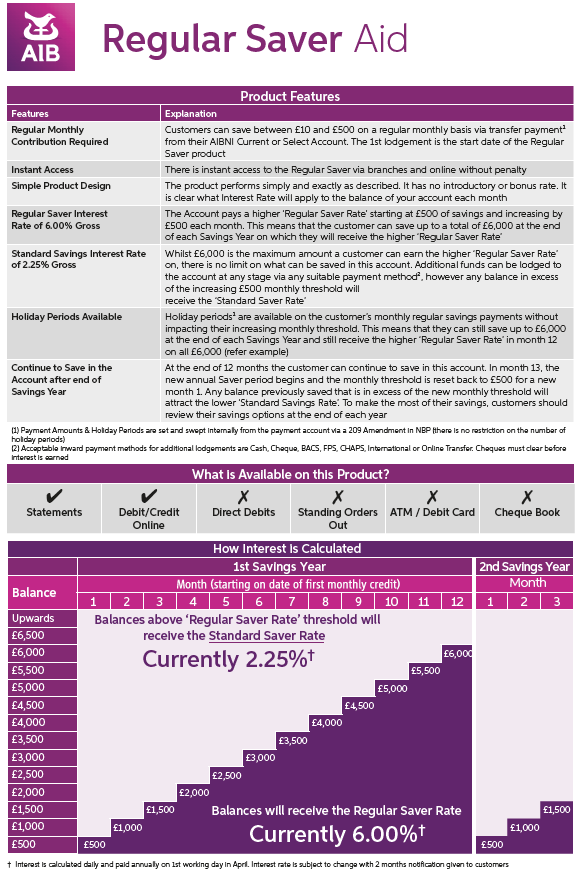

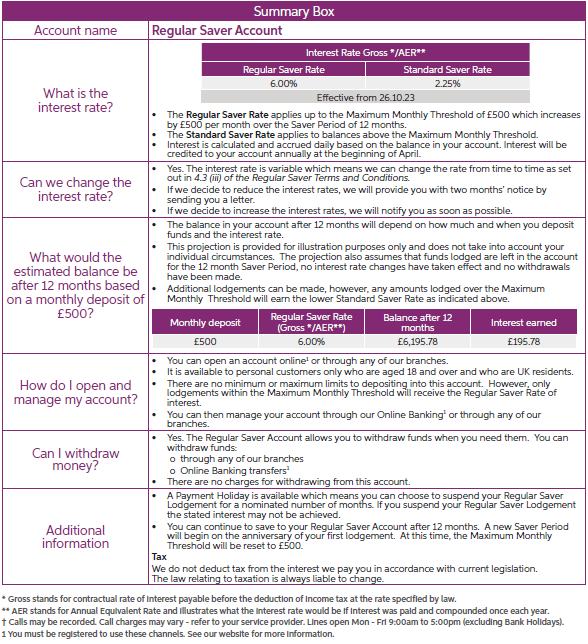

- Earn up to 6.00% Gross*/AER** variable interest on savings of between £10 and £500 per month for up to 12 months

- Access to your savings without penalty in-branch or online

- Add to your savings anytime without restriction

- Take a payment holiday if you require

- Carry on saving in the account after 12 months

- Open your account today

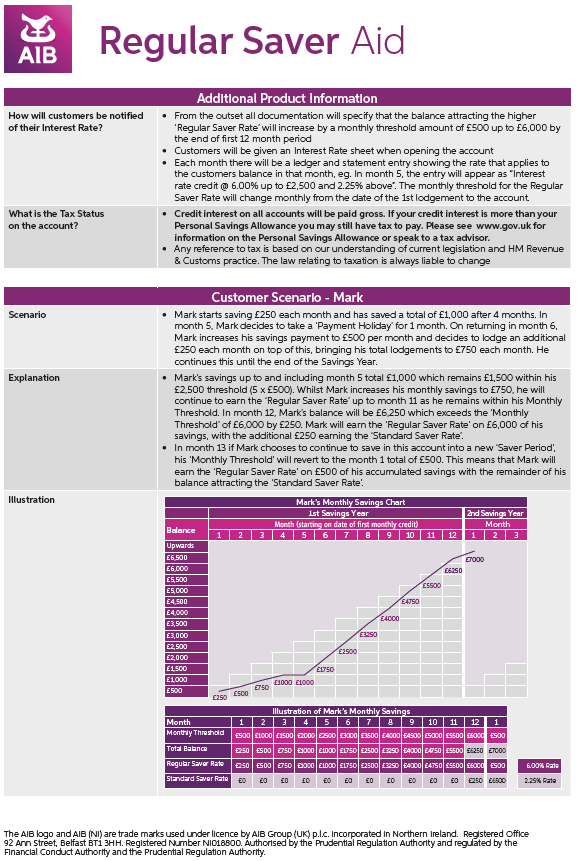

How does it work?

- A more detailed explanation on how the account works

Regular Saver Account Summary Box

This summary box sets out key product features that apply to our Regular Saver Account. You should carefully read this document along with the Regular Saver Account Terms and Conditions to allow you make an informed decision as to whether this product is right for you.

If you require this summary box in PDF format, please download here.

Talk to Us

We’re ready to help you start saving today.

Simply call us on 0345 6005 925† , or drop into any AIB branch. We’ll be happy to answer any questions you may have and help you find the right kind of savings account for you.

† Lines open: Monday - Friday 09:00 - 17:00(except on bank holidays). Calls may be recorded. Call charges may vary - refer to your service provider.

Help and Guidance

Terms and conditions

View the Regular Saver account terms and conditions

Savings calculator

Find out how even the smallest amount of regular savings will add up

Deposit rates

Find out more about our deposit account rates

Help Centre

For all service related queries please visit our Help Centre.

Important information about taxation

Find out how we apply tax on savings in line with current legislation.

Financial Services Compensation Scheme

Check what protection the Financial Services Compensation Scheme offers you.