Secure FAQs

Frequently asked questions received through 'My Messages'.

'How do I?' queries

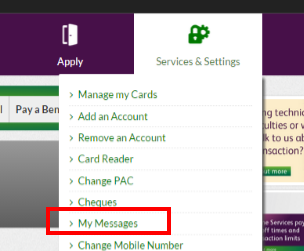

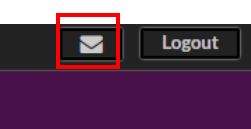

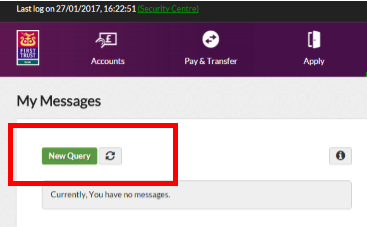

- How do I send a Secure Message?

Card queries

- My Visa debit card is due to expire this month, when will I receive my new card?

- How do I order a replacement Visa debit card?

- I am having problems using my card when shopping Online due to Verified by Visa, can you help?

- I am travelling abroad, do I need to inform AIB (NI)?

Account queries

- How long does it take for a cheque to clear?

- How do I close an account?

- I can’t transfer money from my Cash ISA account via Online Banking, why?

Payment queries

- How do I cancel a Direct Debit?

- How do I cancel a Standing Order/Regular Payment?

- I want to change my Standing Order/Regular Payment from weekly to monthly, how do I do this?

- I sent a payment to my sister's account with Santander last night, why did she not get the payment straight away?

- I need to make a payment for £50,000 to my solicitor, how can I do this?

Lending queries

- How do I get an overdraft on my account?

- I would like to borrow £5,000 for a new car, how do I do this?

- I applied for a Personal Loan via Online Banking, how do I check if it was approved and what happens next?

- How do I apply for a Visa or MasterCard credit card with us?

Fee queries

- How can I minimise my account fees and charges?

- Where can I view my fee advice?

Online Banking queries

- My new card reader has arrived, but Online Banking is not accepting the codes. What do I do?

- How do I make a payment to my credit card?

- I need to make a payment to my mother's account with another UK bank. How do I do this?

- I need paper copies of my last three statements, how can I order these?

- I want to view historic transactions on my account, but they are not shown on my recent transactions. How do I do this?